Although we’ve been stating it for much of the year, new research by Enness Global Mortgages has confirmed that space is the most important factor for high-end homebuyers with a distinct swing from flats to detached houses now clearly evident.

With all the news regarding social-distancing and the lockdown forcing people to stay at home this year, it comes as little surprise that flats are no longer at the top of property hunters wish-lists. Over the past six months, we’ve highlighted, or to be more accurate, speculated that homebuyers affection for flats was waning and the preference for more space would be on the increase.

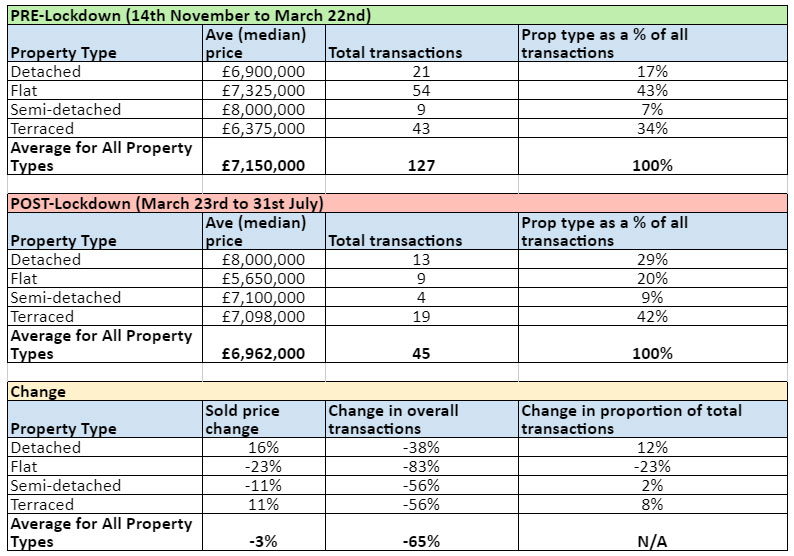

It’s all very well speculating, but what is really needed is accurate, current data and Ennes Global have kindly provided this. They’ve analysed sales by property type at £5m and over across England and Wales, looking at the average sold price and what percentage of total transactions each property type accounted for.

The research shows that in the months leading up to lockdown, detached homes accounted for just 17% of total transactions above £5m, while flats accounted for a notable 43% of all transactions.

At the same time, the average house price for all properties sold at £5m and over was £7.150m. However, flats were selling for above-average (£7.325m), while detached homes were selling for below average (£6.9m).

But lockdown restrictions have caused a swing in the buying trends of the super-wealthy.

Since lockdown started on 23rd March, overall transactions above £5m have understandably fallen by -65%. Still, detached home sales have seen the smallest decline of all property types, down by just -38% compared to an -83% reduction in the sale of flats.

However, those transactions that have completed demonstrate a clear swing in the appetite of super-rich home buyers when it comes to property type.

Detached property transactions above £5m have accounted for 29% of all transactions; a 16% increase. Flats, on the other hand, have accounted for just 20% of all transactions; a -23% reduction.

What’s more, the average price paid for detached homes has increased by 16% to £8m, while the price paid for flats has fallen by -23% to £5.65m. In fact, detached homes are the only property type to see an increase in the average sold price since the lockdown.

Despite this, detached home high-end buyers are still securing better value, with the average price paid per square foot currently £6,405 compared to £8,626 for the average flat, although the good news for sellers is that detached homes are the only property type to see an increase in the price paid per square foot.

Group CEO of Enness Global Mortgages, Islay Robinson, commented: “Traditionally, buyers at the very top end of the market would snap up flats left-right and centre for a number of reasons.

Many already have a primary residence, and so they purchase flats as additional homes to provide the convenience of a central location in their chosen city.

They always want a great view, as well as the additional amenities such as a concierge, cleaning service and so on, with some also buying with rental potential in mind. All of these factors make for a very low maintenance investment with maximum benefit.

As a result, sold prices for high-end flats have eclipsed other property types consistently, but this has all changed with the current pandemic.

Now, buyers at the very top end want safety, security, privacy and, most importantly, more space. This has caused a complete turn around in terms of which property types are selling and what they’re selling for, with detached homes now driving the prime property market forward on both fronts.

That said, while a detached house will cost you more in current market conditions, they still represent better value when it comes to the price paid per square foot.

Although restrictions have eased, the threat of the current pandemic continues to linger, and so we expect this trend to intensify as time goes on.”

The below table looks at property transactions and sold prices during the same time frame pre and post-lockdown. Data sourced from the Land Registry Price Paid records.

Read more property articles and guides in our dedicated section here.

![]()

You must be logged in to post a comment.