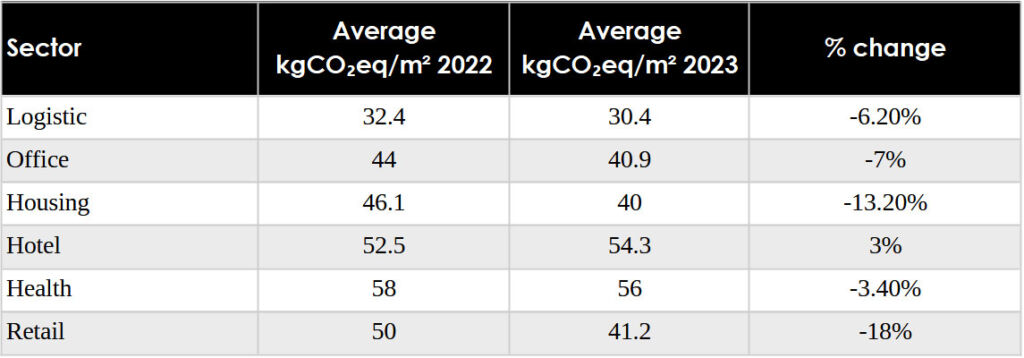

Data from the newly released Deepki ESG Index reveals that carbon emissions from the UK real estate sector have fallen. The largest fall was in the retail real estate sector, down by 17.6%, while the UK housing sector saw a fall of 13%. However, carbon emissions from the hotel sector increased when compared to 2022.

Deepki, the only company in the world offering a fully populated ESG data intelligence platform for the commercial real estate sector, has today released findings from its “ESG Index“, which shows a significant drop in carbon emissions from the UK real estate sector.

In the UK, the built environment accounts for around 25% of all carbon emissions[1]. In general, the United Kingdom’s climate contributes to relatively high energy consumption when compared to some other European countries, while its gas-based energy mix results in higher carbon emissions.

The UK retail sector has seen the biggest average drop in carbon emissions per real estate unit over the past year of around 17.6%. This is followed by housing, where average carbon emissions per unit have fallen by 13.2%.

Of the six real estate sectors reviewed, only the hotel industry saw a rise in average CO₂ emissions – 54.3 kgCO₂eq/m² per unit in 2023 compared to 52.5 kgCO₂eq/m² in 2022 (a rise of 3.4%).

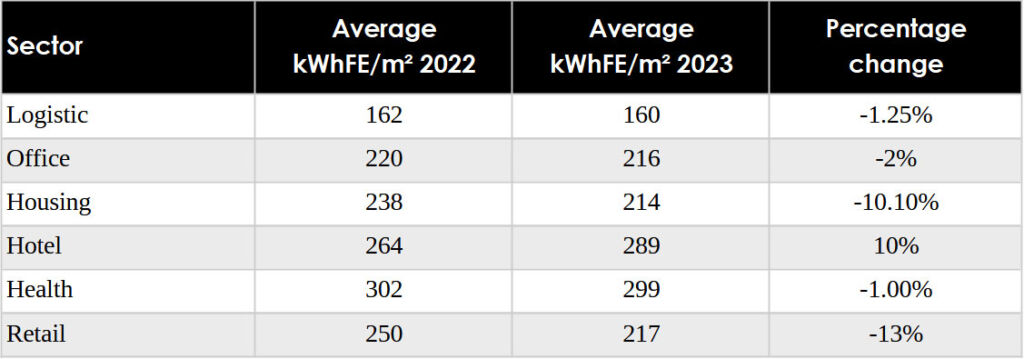

One key reason for a fall in carbon emissions from real estate in the UK is that average final energy consumption across the UK real estate sector has fallen by 2.86% between 2022 and 2023.

It has fallen by 13.2% in the retail real estate sector, which is the biggest drop of the six typologies reviewed, and this is followed by the housing sector, which saw a fall of 10.1%. However, the average final energy consumption per real estate unit in the UK hotel sector increased by 9.5%.

Commenting on the findings, Lindsay Taylor, Head of UK Delivery at Deepki, said, “We have undertaken detailed analysis to create the only Index of its kind. The findings show that key typologies across commercial real estate in the UK are embracing the path to net zero and moving in the right direction.

Measures that are being implemented to improve the carbon footprint of assets through greater energy efficiency, such as improving insulation and ensuring better regulation of equipment such as lighting, heating, ventilation, and air conditioning so that they are in tune with use patterns and seasons, are starting to pay dividends, although we must bear in mind the effect of the climate itself.”

The publication of Deepki’s latest ESG Index findings marks a year since its launch as the first publicly available European benchmark measuring real estate’s environmental performance using real data.

Following its initial publication in late 2022, it was positively received by the market, which was desperately lacking a common framework in order to tackle the challenges brought about by tightening regulations, such as the SFDR.

The Index gives values for the average, top performing 30% and top performing 15% in terms of energy consumption and CO2eq emissions for different typologies across the real estate sector in the UK, France, Germany, Benelux, Italy and Spain, as well as Europe as a whole, thereby defining which investments are sustainable according to the EU Taxonomy.

In order to redirect investment flow in line with the 2050 net zero target, the European Commission has detailed certain performance criteria in the EU Taxonomy. According to these criteria, buildings in the top 15% of the national or regional building stock in terms of primary energy intensity will be considered sustainable investments and serve as a benchmark for the entire sector.

The newly published Index shows that the evolution of the UK and Europe’s commercial real estate sector’s ESG performance varies from year to year depending on the typology, with housing, offices, healthcare and retail seeing a drop in final* energy consumption in contrast to hotels, which have increased, while logistics remains stable.

Methodology

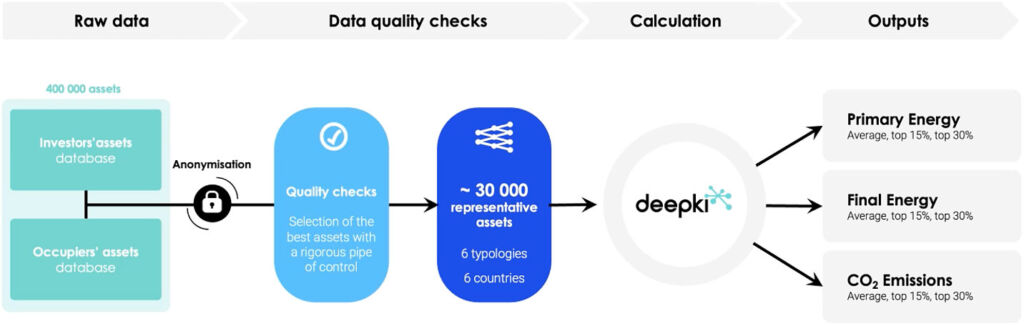

By automatically collecting actual – rather than declarative – data from more than 400,000 assets, Deepki can share in-depth insights into the real estate sector’s energy performance by asset type and location. Data from over 60 types of buildings is rigorously checked by Deepki’s in-house data scientists to ensure the most accurate results for the six typologies published.

With values for the top 15%, the market can identify the assets contributing to a reduction in climate change according to the EU Taxonomy. The top 30% will allow the market to determine which assets contribute substantially to the EU Taxonomy’s objectives and do no significant harm in the fight against climate change.

References:

[1] Climate Change Mitigation | UKGBC

The ESG Index serves as a benchmark for assessing the energy and carbon performance of commercial properties. It provides a reference for the performance of buildings within Asset Managers’ portfolios.

The ESG Index bases its results on a continuous study of data analysed from 2022 and 2021. The benchmark is updated annually and represents a true reflection of the European market and its systemic evolutions, with historic results being updated with each release to take into account new, previously unavailable data.

*Final energy consumption: Final or available energy is the energy delivered to consumers for end consumption (petrol at the pump, electricity in the household, etc.).

** Primary energy consumption: Primary energy includes all energy products not transformed, directly exploited or imported. It mainly includes crude oil, oil shale, natural gas, solid mineral fuels, biomass, solar radiation, hydraulic energy, wind energy, geothermic energy and the energy taken from uranium fission.

Source: www.insee.fr.

Read more property and construction news here.

![]()

You must be logged in to post a comment.