New research has revealed that some relatively modern properties can cost more to insure than those built fifty, sixty or even seventy years ago. Surprisingly, homes built in the 2000s are, on average, more expensive to insure than those built in any decade since the 1940s, with 2020s properties carrying lower premiums. To understand why, Nathan Blackler, a home insurance expert at Go.Compare, takes us through the data.

The data shows that older homes usually have higher premiums, while newer ones see some of the lowest, yet those built in the 2000s are among the most expensive. Now, homebuyers are being warned about falling into this trap when searching for a property.

The figures are based on internal data from Go.Compare home insurance, which looked at the effect of property age on policy prices.

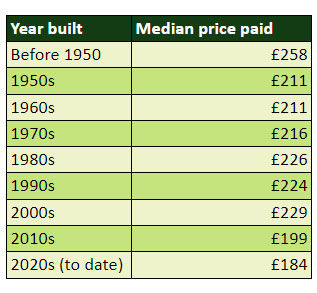

According to the data, a property’s age can impact your premium by an average of £37, although the median cost varied by up to £74 in some instances.

Those built in the 2020s have median policy prices of £184, the cheapest of any decade, and premiums for properties built in the 2010s are similarly low at £199. However, the cost shoots up to £258 for those made earlier than 1950.

The age of the policyholder can have a similar impact on prices. Older homeowners are generally seen as less of a risk due to being more security-conscious and financially secure. The median premium varies by up to £68 based on age – £37 on average.

Nathan Blackler, home insurance expert at Go.Compare, said, “Older homes tend to have higher insurance costs as they suffer from age-related problems, which is why it’s so surprising that those built in the 2000s are among the most expensive.

“The reason for this could be because there was a housing shortage in this decade, which might have driven a quantity over quality approach to housebuilding. This could have resulted in a wave of homes that are less durable, leading to more claims for properties made in this decade and higher premiums.

“It also could be that the most recent houses are higher cost because they are more likely to be occupied by younger people. Younger policyholders can sometimes have higher premiums than older residents as they’re generally less security conscious and less financially secure, among other reasons.

“As a result, this could be pushing up the average for homes built in the 2000s. The 2000s aside, the lower premiums that usually come with new builds could make them a good option for younger residents.

“This research shows why it’s really important to check insurance prices before moving or changing your home. Comparing policies will allow you to see how changing things might affect your premium, allowing you to take any extra costs into account in your budget. You can also try reducing insurance costs by avoiding unnecessary add-ons, improving security and making sure you don’t pay for more cover than needed.”

More information on the factors that most impact home insurance premiums, including tips to bring down prices, can be found on Go.Compare’s website.

Methodology

¹ Median prices split by location, property type and property size are based on combined buildings and contents home insurance policies purchased through Go.Compare from 1 July 2024 to 30 September 2024.

Prices for all other factors are based on the median premium of home insurance sales made through Go.Compare between April 2024 and June 2024 for combined buildings and contents cover type. The figures used are based on policies paid annually.

To determine which variables had the biggest impact on the price paid for home insurance, they took the largest and smallest difference between points for each variable considered. The variables considered were the number of bedrooms, property location, the year the property was built, policyholder age, roof type, front door lock type, time of day occupied and property type.

They then took the average between the largest and smallest difference, giving an indication of the average amount the policy price changes between points for each variable.