The Governments Stamp Duty Holiday is designed to boost interest in the property market, and it seems to be doing the job with estate agents reporting phones ringing off the hook. But, to maximise its effect, mortgage lenders need to do their part, we look at whether they are?

Earlier this year, the property market entered into a holding pattern due to the COVID-19 outbreak. During this time, people’s interest in wanting to move whether upsizing or downsizing didn’t diminish with many property portals reporting record visitor numbers.

It was obvious that the appetite for the property market hadn’t diminished and I’d liken the situation to someone slowly shaking a bottle of fizzy pop. Once the stopper was removed, well, I think you get the picture.

Many commentators said this renewed interest would be just a short-term surge and what they perceive as reality would eventually hit. Surprisingly, for the negatively focused among them, the interest didn’t fizzle out. There is always a risk it might do. Fortunately, the stamp duty holiday has added more fuel to the fire which has resulted in the frenzied interest we’re witnessing today.

I believe the rationale behind this is: a buoyant property market makes people feel wealthier; this results in more spending and an overall boost to the economy. But, to ensure the stamp duty holiday has the greatest effect, all parties need to chip in and help out, and one of the most important parts of the equation is the mortgage lenders.

With regards to mortgage lenders, we need to ignore the spin and marketing, you know the type; “we are here for you”, or “we will always be on your side”, “we’ll make your dreams come true” etc. To get to the crux of the matter, we need hard data and one of the best places to get this is from moneyfacts.co.uk.

Are mortgage lenders doing their part?

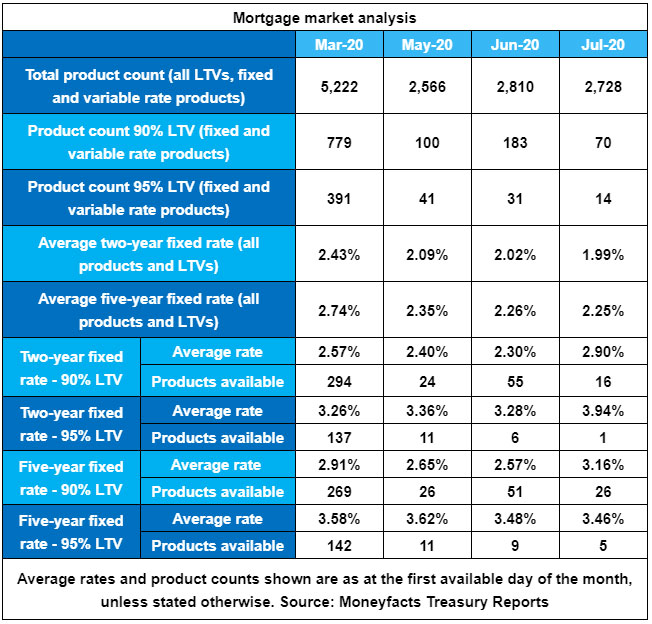

Disappointingly, it seems they are not. The Moneyfacts UK Mortgage Trends Treasury Report data, (not yet published), has revealed that after a slight recovery last month, the number of products in the mortgage market has dropped. There are now 82 fewer deals available at the start of this month when compared to the beginning of June.

The high loan-to-value mortgage products seem to have been impacted the hardest. In July, there are only 16 two-year fixed products available at 90% LTV, 26 equivalent five-year fixed rate deals, and at 95% LTV, only one and five products respectively.

After hitting record lows in June, both the two and five-year average fixed rates reduced even further to 1.99% and 2.25% respectively – the lowest recorded since our records began in 2007. However, in the higher LTV tiers, there is a different story unfolding that may concern borrowers with a low deposit or equity, with the two-year fixed average rate at 90% LTV increasing by 0.60% month-on-month to 2.90%, and by 0.66% to 3.94% at 95% LTV.

It’s understandable that mortgage lenders are becoming warier when it comes to higher loan-to-value lending, particularly with the high number of job losses expected from the high street retail sector. It’s almost laughable that PPI (Payment Protection Insurance) was made a pariah over the past few years, and here we are today, in a situation where it could actually provide some peace of mind and do what it was designed to do.

Eleanor Williams, a Finance Expert at Moneyfacts, said: “A recent survey by RICS* indicated that despite the number of new properties being listed on the market rising in June, the supply of available property for sale remained close to its record low, with on average just 39 per branch available. As the housing market is a crucial component of the British economy, the fact that homebuyers looking at purchasing a property worth approximately £250,000 could now save on outgoings in the region of £2,500 with the change to stamp duty, will hopefully encourage more to move forwards with their transactions.

“However, our research shows that there still remains a dearth of available products. After a minor rally last month, July saw overall product choice fall again, starting the month with 2,728 products on offer. March began with 779 products available at 90% LTV, which had dropped by 91% to 70 products on offer at the start of July – a record low based on our Treasury report data, beating the previous low of 71 products in May 2009.

“At 95% LTV, there is a similar story with only 14 products on offer, which is close to the record low for products in this sector (three products in May 2009). The majority of the available products at this level now are specialist options. This includes guarantor and family assist mortgages, such as the Barclays Springboard mortgage, and those open only to applications from selected professions or from those in specific lending areas, with products such as those offered by Furness Building Society that reflect its principles as a mutual to continue to support those in their local area.

“This information could be disappointing to many would-be borrowers who may not have someone to guarantee, do not work in the specified job roles, or do not reside in the relevant postcodes, especially considering that while savings rates continue to plummet, increasing their level of deposit is likely to more be difficult.

“However, it bears noting that lenders have been launching products in the high LTV sectors, particularly at 90%, and over the course of a month the numbers of available deals can fluctuate enormously.

“It seems that while lenders have the appetite to lend, intense customer demand being levelled at the small number of providers who have relaunched in these tiers is overwhelming, at a time when operational capacity is already stretched, and there continue to be existing customers requiring support with payment difficulties in addition to new business underwriting. Therefore, until more lenders return to this space with products to support the clear borrower demand, it seems likely that we will continue to see an ebb and flow in availability.

“June’s record low average rates have dropped even further this month, seeing the overall average two-year fixed reduce to 1.99% and a slight fall on the five-year average to 2.25%. When we consider that at 90% and 95% LTV the two-year fixed-rate average has increased by 0.60% and 0.66% respectively and, despite the five-year average at 95% making a small reduction of 0.02%, the five-year at 90% has also increased by 0.59%; this makes the reduction to the overall average rates even more significant. This is likely due to the fact that the low to mid-LTV tiers have seen rate reductions over this same period, indicating increasing rate disparity between high and low LTVs.

“We are left with a very mixed picture for potential new mortgage customers. Those with higher levels of deposit or equity are seeing continued reductions in the average rates available and the prospect of saving potentially thousands on stamp duty will be a fantastic incentive to progress any home moves. However, for those with only 5% or 10% deposit or equity, the outlook remains bleak. For the stamp duty holiday to succeed in encouraging more prospective borrowers to take that next step on the property ladder, the demand for products, especially in the high LTV tiers where most of the fluctuations in availability are focused, needs to be met.”

*RICS UK Residential Market Survey, June 2020.

Read more finance and property-related articles in our dedicated section here.

![]()

You must be logged in to post a comment.