The easing of restrictions sees a raft of new rental properties coming onto the market with some areas seeing a 44% spike in new listings.

In the wake of last week’s ease of property market restrictions, the number of rental properties hitting the market surged by as much as +44% in some UK cities as landlords returned and letting agents were able to resume business.

Howsy’s research analysed the number of available rental properties listed across the major portals the day after lockdown restrictions were eased across the UK property market, before comparing this to the number of properties listed in April.

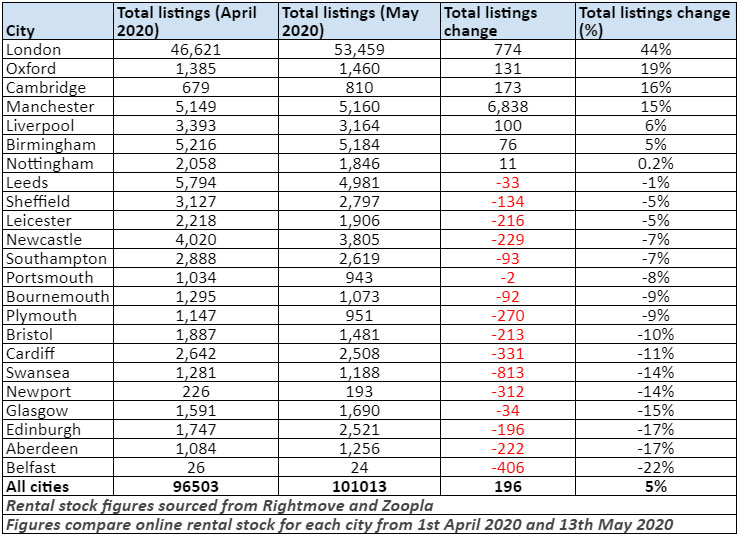

The figures show that across 23 major UK cities, the number of rental properties now available to UK tenants has seen an immediate uplift of 5% on average. This increase has been driven by just seven cities, while the rest have seen further declines in rental stock levels.

The largest increase based on the sheer number of properties have been in London, with an additional 6,838 immediately hitting the portals, an increase of +15%.

In terms of percentage increases, Edinburgh has seen the largest influx with an uplift of +44%.

Cambridge has seen rental stock bolstered by +19%, with Aberdeen (+16%) also registering a double-digit increase.

Glasgow (+6%), Oxford (+5%), and Manchester (+0.2%) have also seen a lift in rental stock levels.

However, other cities are yet to see a knee-jerk market recovery, with Bristol seeing stock levels fall by -22% since April. Bournemouth (-17%) and Plymouth (-17%) have also seen some of the largest declines.

Callum Brannan, Founder of Howsy said: “Many in the rental sector will be breathing a sigh of relief with such immediate green shoots of market activity returning to a number of cities following an easing in lockdown market restrictions.

Of course, other pockets of the market will take longer to see this positive trend emerge as agents and landlords find their feet operationally.

We’re certainly not out of the woods yet and the ongoing financial and health implications facing many tenants and landlords will continue to be an obstacle. However, now that we as an industry are able to facilitate them on a greater scale, we can at least start to rebuild momentum in the sector.

Now, it’s vital that landlords receive the support and protection they need from us as an industry, to ensure confidence in their investment and to maintain a suitable level of rental stock to meet demand from tenants who rely on these homes in order to live.”

Read more property-related articles in our dedicated section here.

![]()

You must be logged in to post a comment.