Moneyfacts, the UK’s leading independent provider of finance product data, is advising UK savers to keep an eye on current account credit interest rate offers as time is running out to secure the best deals.

According to Moneyfacts, savers using a high credit interest current account as a haven for their cash would be wise to keep a close eye on lucrative offers over the next few days, as rates are being slashed.

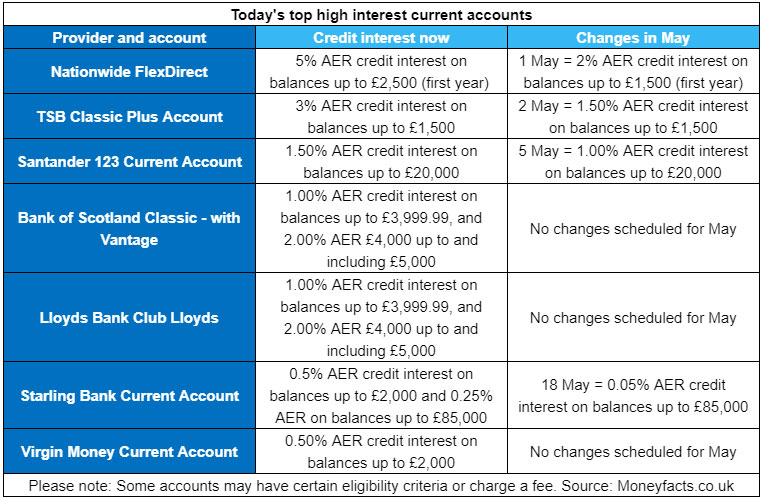

Analysis of the top deals available today shows that consumers have just a few days left to take advantage of the top rate on offer from Nationwide’s FlexDirect Account, which pays 5% AER for 12 months.

Rachel Springall, a Finance Expert at Moneyfacts.co.uk, said:

“Time is running out for consumers to secure the top high-interest rate available on a current account, with just days in fact. Not only is the top rate of 5% credit interest disappearing from the current account market, but other providers, such as Santander, Starling Bank and TSB, are cutting their own credit interest rates next month, too.

“It seems that in a low-interest-rate environment, the impact of the Coronavirus (COVID-19) pandemic is having an effect on the current account market now, too.

“If consumers want to earn 5% AER (4.89% gross) for the next 12 months on a current account, then they will have to apply before 1 May to Nationwide to open its FlexDirect Account, where it will pay this rate on balances up to £2,500. After this date, the credit interest rate will drop to 2% AER (1.98% gross), and it is applied to balances up to £1,500.

This is calculated as a yearly interest loss of £95 based on the AER rate drop and lower balance to earn interest on (5% on £2,500 versus £2% on £1,500). It’s disappointing to see such a lucrative offer being cut, but Nationwide had offered 5% AER on its FlexDirect Account for new customers for the past seven years, albeit applied for only the initial 12-month period of account opening.

“If consumers are comparing other deals, they may want to keep in mind that Santander and TSB are also cutting their credit interest rates in May. The 123 Current Account rate will drop from 1.50% AER (1.49% gross) on balances up to £20,000 to 1.00% AER/gross – that’s a yearly interest loss of up to £100 based on the AER rate drop.

The rate on the TSB Classic Plus will drop from 3% AER (2.95% gross) on balances up to £1,500 to 1.50% AER/1.49% gross, which is a maximum yearly interest loss of £22.50 based on the AER rate drop. Starling Bank will also be dropping its Current Account 0.50% AER credit interest rate to 0.05% AER in a few weeks too.

“These cuts will be another blow to savers who are seeing interest rates plummet across the savings market as it will become more difficult to get a competitive return on their cash, but current accounts could still be a salvation for savers regardless, as the top high-interest current accounts can pay better rates than most of the standard saving account market.

Apart from credit interest, there have been other means for consumers to earn something extra from their current Account, such as with switching incentives. However, many providers have withdrawn these offers since the start of this year, for example, with HSBC stating its focus was to support their customers affected by the Coronavirus outbreak.

“During these uncertain times, it’s important consumers take time out to ensure they have the most suitable Account for them to weather the storm. It’s quick and simple to switch an account using the Current Account Switch Service (CASS), and they may be financially better off to do so.”![]()

You must be logged in to post a comment.