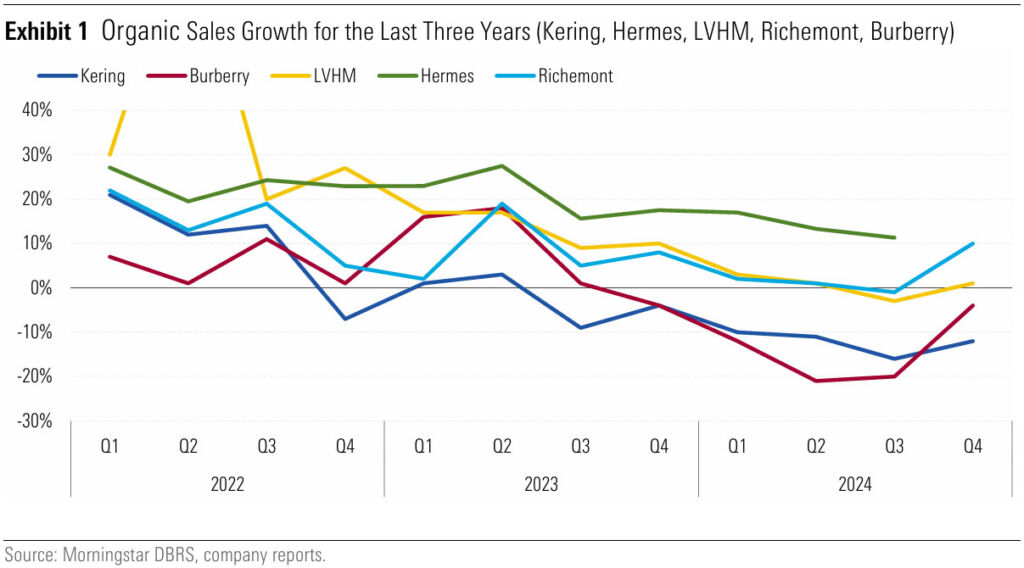

In a year when luxury consumer companies generally performed ahead of expectations, delivering mild sales growth and defying expected declines, Kering S.A. (Kering) was an outlier. This week, the French luxury goods company, owner of brands like Gucci and Yves Saint Laurent, reported a Q4 2024 sales fall of -12%, missing the turnaround in sales growth experienced by peers such as LVMH Moët Hennessy Louis Vuitton SE (LVHM) and Compagnie Financière Richemont S.A. (Richemont).

Chinese consumption of luxury goods is rebounding, which is a key positive factor driving the European luxury industry, but there is now a looming risk for the sector that could cause further problems for Kering: U.S. tariffs.

The U.S. market represents a hefty portion of the leading European luxury companies’ annual sales—20% to 25% on average for LVMH, Richemont, Kering, Hermès International S.A. (Hermès), and Burberry Group plc (Burberry).

Analysts at Morningstar DBRS believe luxury goods are easy targets for tariffs, as they only increase costs for a select group of wealthy people, leaving the general population unaffected.

A 10% to 20% tariff on European luxury goods could depress luxury sales in the U.S., especially for companies like Burberry and Kering that focus more on an affluent and aspirational clientele as opposed to the ultra-rich patrons targeted by Hermès and LVHM.

What is Happening to Kering?

Kering’s sales dropped by -12% in F2024, while EBITDA decreased by -46%. Italian luxury fashion house Gucci represents almost 50% of the group’s sales and is the leading contributor to the group’s performance.

Kering expects 2025 to be a transitional year, as the departure of Sabato De Sarno last week means the group needs to find a new creative director who can revamp Gucci’s image.

Kering is very much fashion focused and therefore less diversified in terms of brands and sectors compared with peers such as LVHM and Richemont. This leads to higher volatility of sales and profits and means the group is dependent on the ever-changing consumer preferences toward its flagship brand, Gucci, which has been highly cyclical in recent years.

The Morningstar DBRS analysts believe that one key reason for the group’s weak performance in 2024 is that Kering’s target clients—aspirational purchasers rather than ultra-rich—are part of the population that has felt the pinch from the cost-of-living crisis fuelled by inflation in recent years.

To a certain degree, inflation benefitted luxury brands until the first half of 2023 because they were able to increase prices, in most cases even ahead of inflation, without depressing volumes.

These price increases are now backfiring, leading to lower sales. Burberry, for example, targets a similar clientele to Kering and reported an average drop of -14% in organic sales in 2024.

U.S. Tariffs: From Bad to Worse?

Following challenges in the Chinese market in 2024, luxury goods companies have been looking to the U.S. to grow their sales. The U.S. market currently represents around 20% to 25% of sales for the most important European consumer luxury companies, including Kering.

Tariffs aimed at this segment could be an appealing option for the new government, as they would not affect the purchases of the general U.S. population but just the wealthiest portion of households. This would mean bad news for Europe, however, where the luxury goods sector represents an important economic engine; for instance, LVHM is the largest private-sector recruiter in France, according to the company.

U.S. President Donald Trump has already demonstrated a willingness to hit Europe with tariffs. While it is still unclear if he will directly target luxury goods, sales of Champagne and Cognac products have reportedly increased since Trump won the election in anticipation of potential tariffs.

Morningstar DBRS sees the risk of tariffs on European luxury goods as relatively high, which could present another stumbling block for companies such as Kering in 2025.

About Morningstar DBRS

Morningstar DBRS is a full-service global credit ratings business with approximately 700 employees worldwide. It is considered a market leader in Canada and in multiple asset classes across the U.S. and Europe.

It rates over 4,000 issuers and nearly 60,000 securities worldwide, providing independent credit ratings for financial institutions, corporate and sovereign entities, and structured finance products and instruments. Market innovators choose to work with them because of their agility, transparency, and tech-forward approach.

Morningstar DBRS brings transparency, responsiveness, and leading-edge technology to the industry. You can learn more about the company on their website, dbrs.morningstar.com.